If you have a home loan in Australia, the Reserve Bank of Australia (RBA) is one of the most influential forces shaping your repayments — even if you’ve never had direct contact with it.

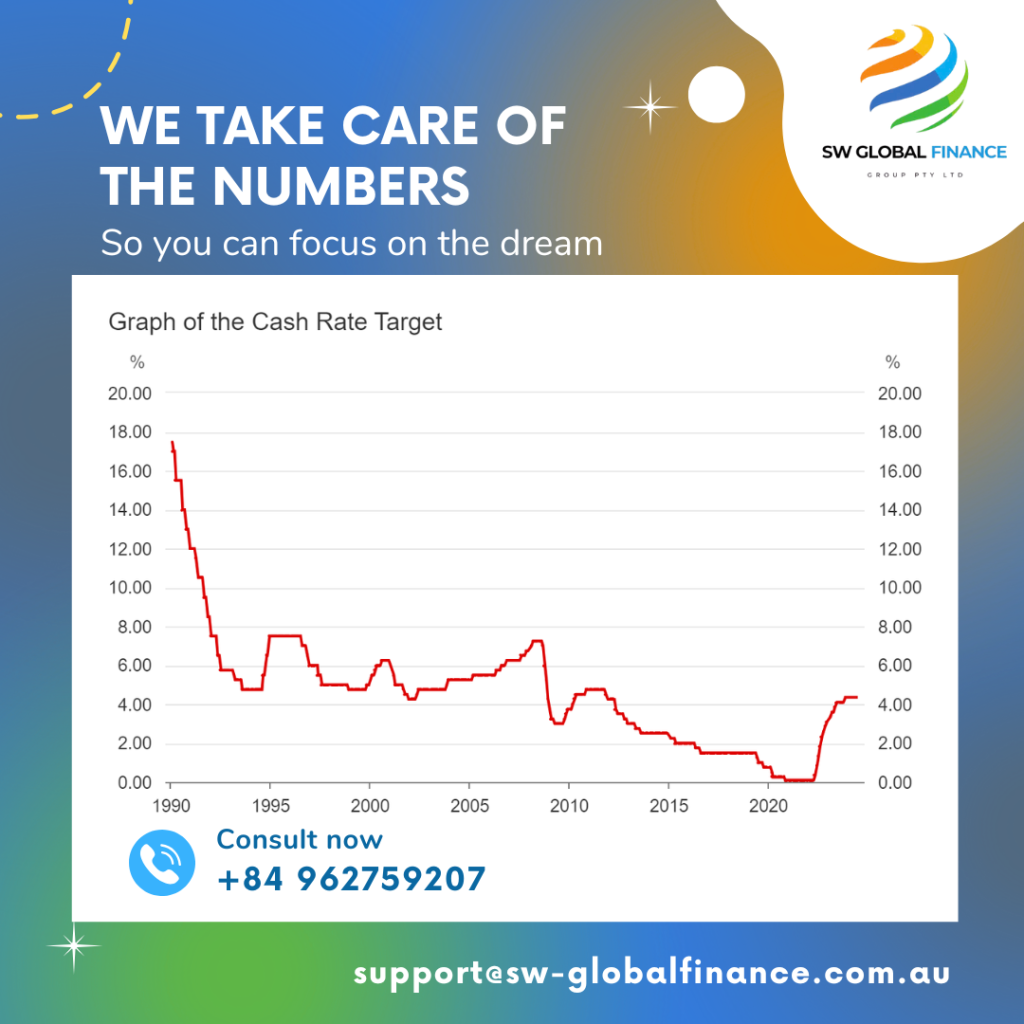

Each month, the RBA sets the official cash rate, which is the benchmark interest rate used for lending between banks. When the RBA moves this rate up or down, lenders typically follow, affecting how much interest you pay on your mortgage.

But what does that really mean for you as a borrower?

Let’s break it down.

What Is the RBA Cash Rate?

The cash rate is the interest rate at which banks lend money to each other overnight. While that might sound removed from day-to-day life, this rate sets the tone for lending across the economy — including your home loan interest rate.

A change in the cash rate often triggers a domino effect:

-

Banks adjust their variable mortgage rates

-

Investment and savings rates shift

-

Consumer borrowing becomes more or less expensive

What Happens When the RBA Raises or Cuts Rates?

If the RBA raises the cash rate:

-

Variable mortgage rates tend to increase

-

Your monthly repayments may go up

-

Borrowing becomes more expensive

-

It can cool down inflation and slow down the economy

If the RBA lowers the cash rate:

-

Mortgage rates may fall (depending on your lender)

-

Your repayments could decrease

-

Lower rates can stimulate borrowing and economic activity

Note: If you’re on a fixed-rate home loan, these changes won’t impact your repayments immediately — but once your fixed term ends, you’ll be exposed to the new rate environment.

Why This Matters for You

Let’s say you’re currently on a 6.29% variable rate. If the RBA hikes the cash rate and your lender raises your rate to 6.79%, that 0.50% difference could add hundreds of dollars per month to your repayments — and tens of thousands over the life of the loan.

Conversely, when the RBA lowers rates, your repayments might not drop unless you actively negotiate with your lender or refinance.

This is why staying passive could cost you thousands over time.

What Should You Do?

-

Know your current rate

Many borrowers don’t know their actual interest rate. Check it — and compare it to what’s available in the market. -

Don’t assume your lender will pass on cuts

Lenders are quick to raise rates, but not always quick to lower them. You need to be proactive. -

Review your loan every 12–24 months

Market conditions change fast. If you haven’t reviewed your loan in over two years, you’re likely overpaying. -

Consider refinancing

Switching to a more competitive lender could reduce your repayments, even if the cash rate stays unchanged.

Final Thought

The RBA doesn’t set your mortgage rate — but it does set the pace. Your job is to stay informed and make sure your loan keeps up.

At SW Global Finance, we help clients build mortgage strategies that respond to real market conditions — not just bank marketing.

Call/WhatsApp: +84 96 275 92 07

Email: support@sw-globalfinance.com.au

Let’s make sure your loan is working for you — not your bank.